1031 tax deferred exchange meaning

The tax deferred exchange as defined in 1031 of the Internal Revenue Code offers taxpayers one of the last great opportunities to build wealth and save. 1031 Tax-Deferred Exchange Definition.

What Does 1031 Tax Deferred Exchange Mean To You Youtube

For example if you purchase a property for 300000 and five.

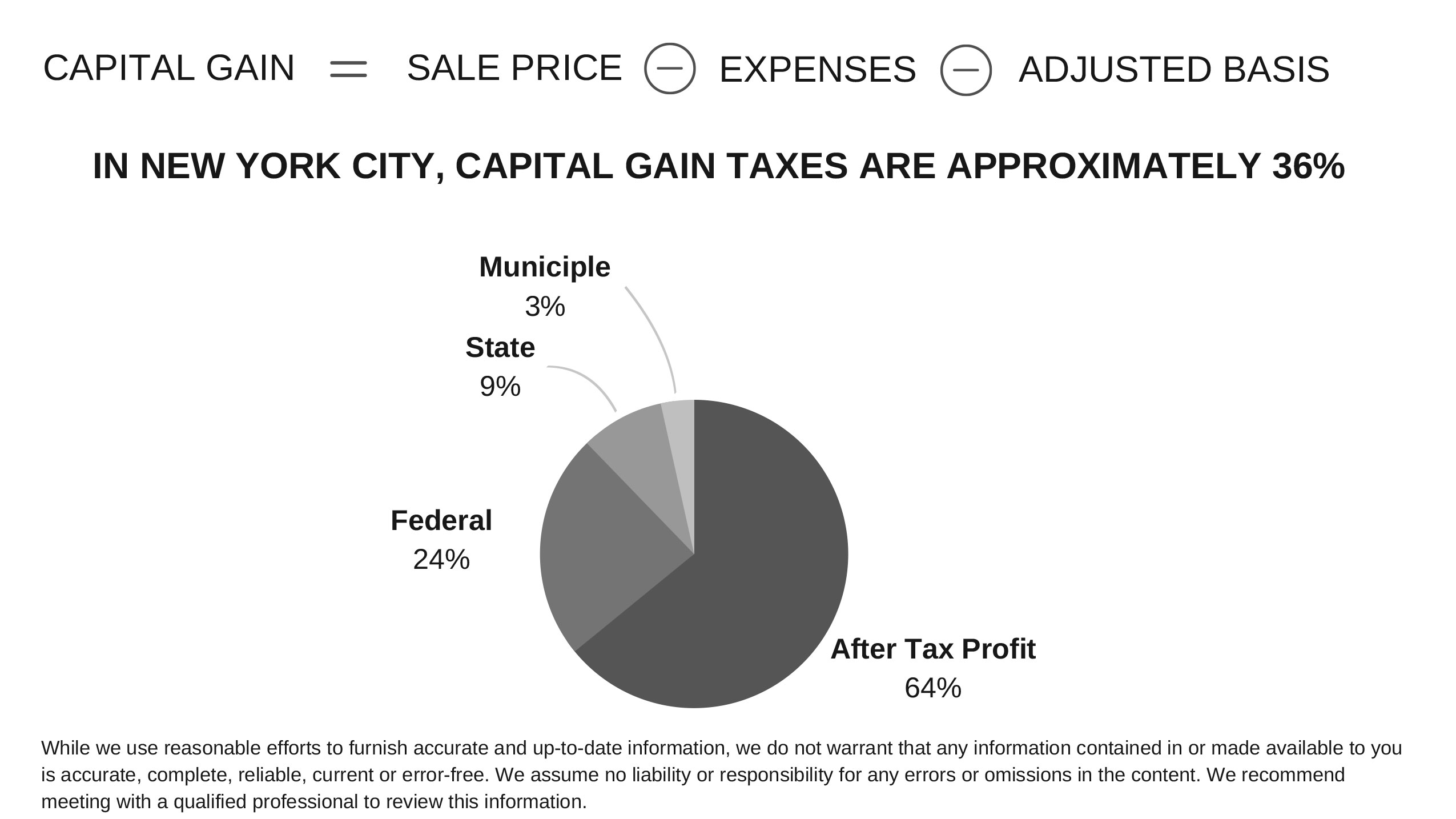

. A 1031 exchange allows you to defer capital gains tax thus freeing more capital for investment in the replacement property. If your long-term capital gains tax rate is 20 that means youd owe 60000 on the sale of that property. For real estate investors 1031 exchanges create an opportunity for investors to move from one property to another and provide tax benefits for.

It is not a tax-free event. What does tax deferred exchange mean. Thanks to the 1031 exchange you can reinvest the profits into.

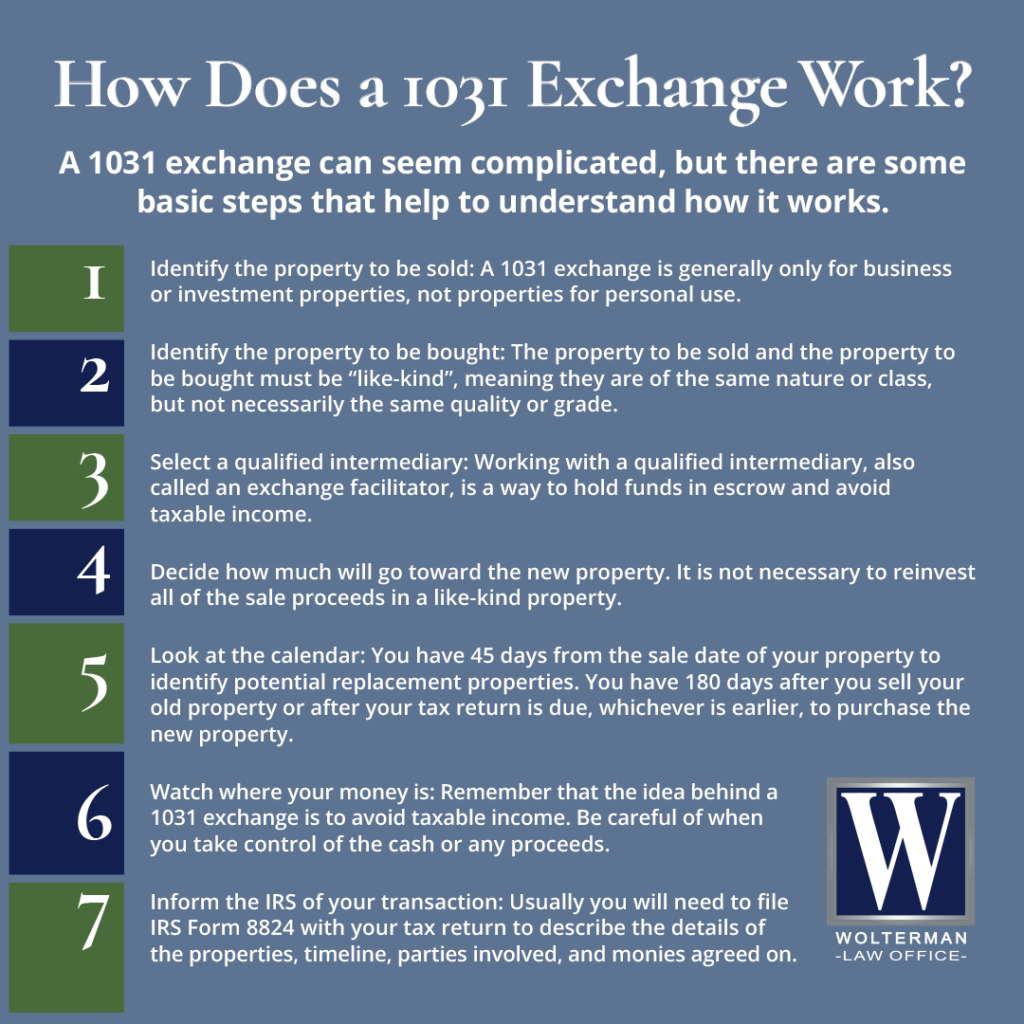

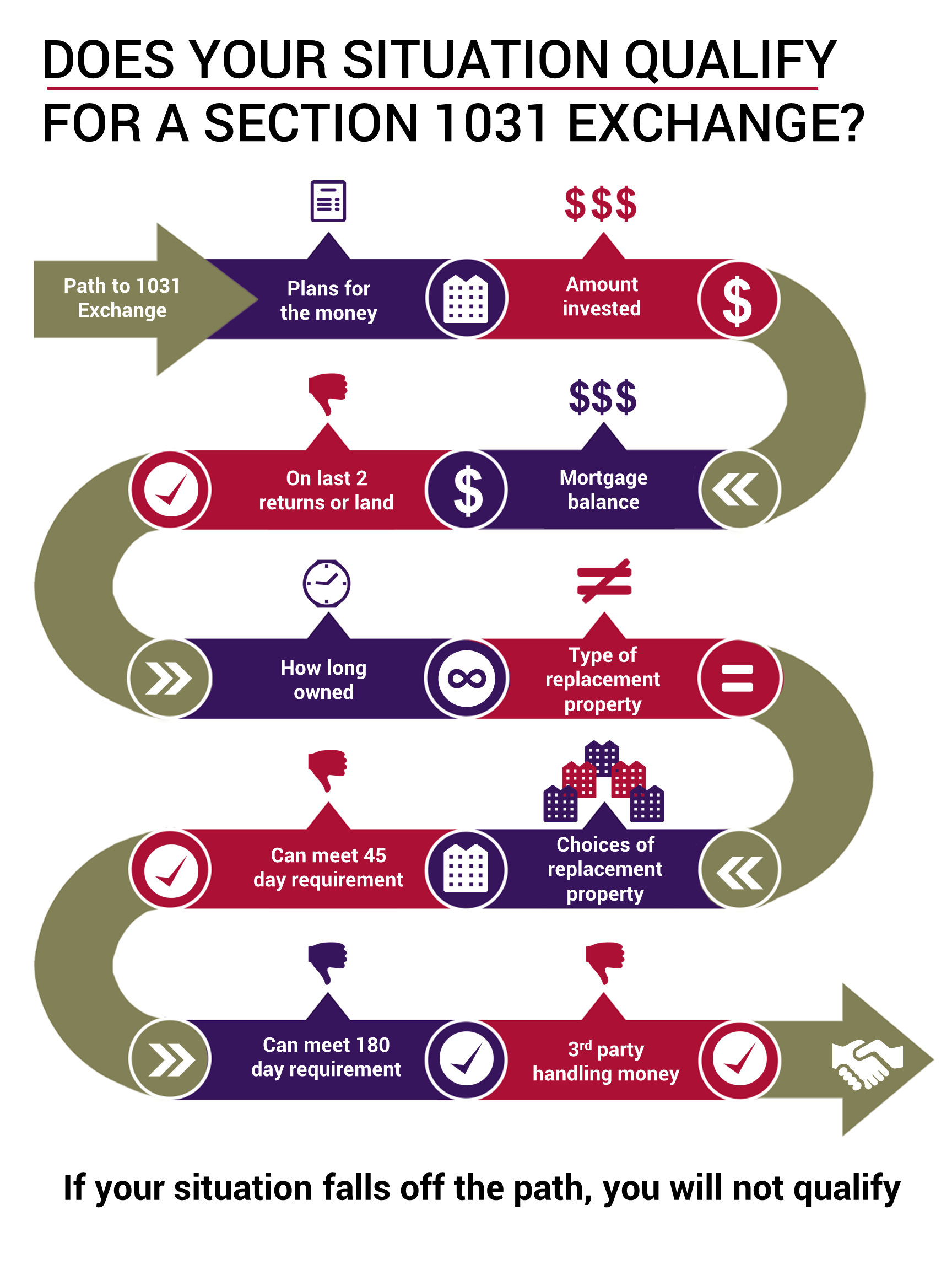

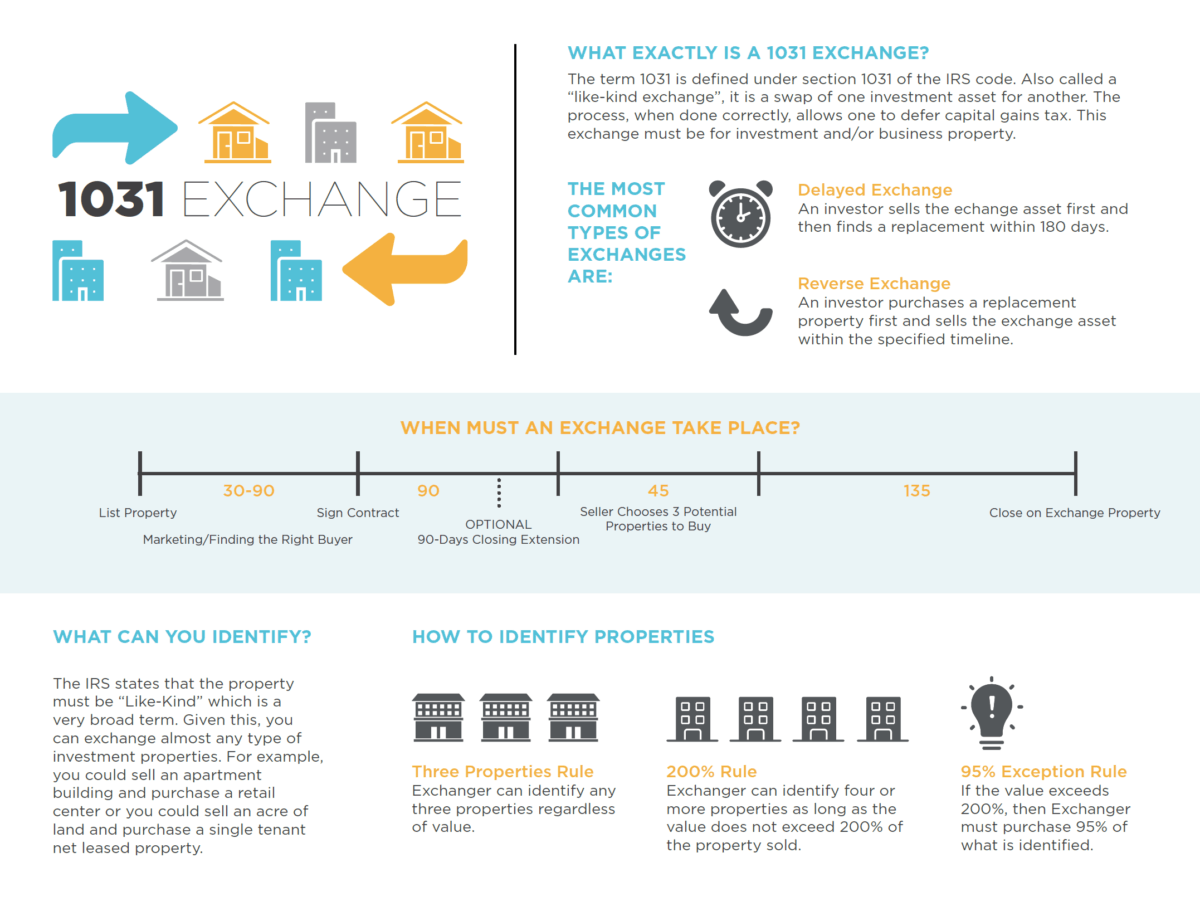

1031 Tax-Deferred Exchange Timeline To qualify as a 1031 exchange you must normally identify the replacement property within 45 days of the sale of the relinquished. Those taxes could run as high as 15. A 1031 exchange is similar to a traditional IRA or 401k retirement plan.

A 1031 exchange gets its name from IRC Section 1031 which allows you to avoid paying taxes on any gains when you sell an investment property and reinvest the proceeds into. A tax deferred exchange is a transaction that permits taxpayers to sell an asset held for investment or business purposes use the proceeds to purchase a like kind investment and. Finance Real Estate Community Advice - RealZelle.

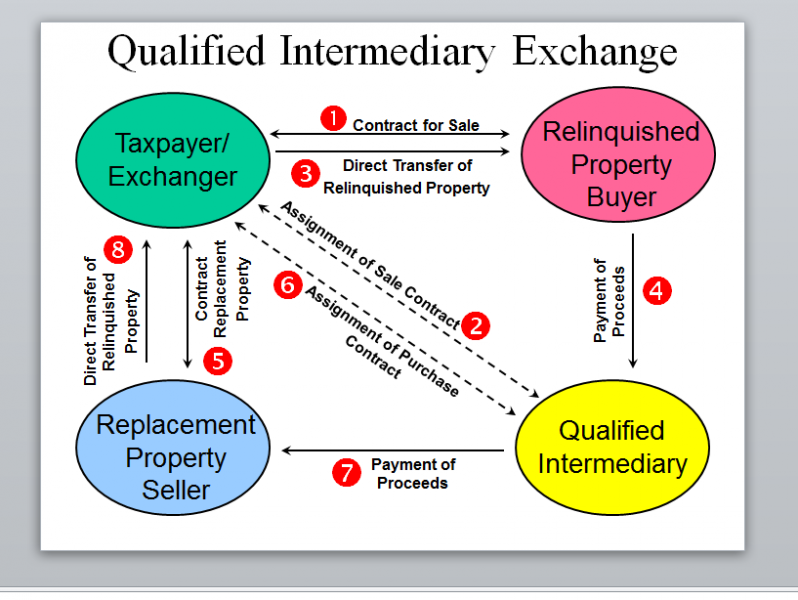

Under Section 1031 of the IRS Code some or all of the realized gain from the exchange of one property for a like kind property may be deferred. You can sell a property held for business or investment purposes and swap it for a new one that you purchase for the same purpose allowing you to. A 1031 exchange is a tax break.

Top 10 Reasons Real Estate Investors Are Jumping into DSTs. The 1031 exchange is in effect a tax deferral methodology whereby an investor sells one or several relinquished. Gain deferred in a like-kind exchange under IRC Section 1031 is tax-deferred but it is not tax-free.

A 1031 Tax Deferred Exchange is one of the few tax shelters remaining. The 1031 tax-deferred exchange is a method of temporarily avoiding capital gains taxes on the sale of an investment or business property. The 1031 tax-deferred exchange is a method of temporarily avoiding capital gains taxes on the sale of an investment or business.

As part of a qualifying like-kind exchange. Its use permits a taxpayer to relinquish certain investment property and replace it with other like-kind. Its important to keep in mind though that a 1031 exchange may.

Tax deferral is a tax-strategy that pushes out the due date on taxes for gains on an investment. However in order to. The exchange can include like-kind property.

What Does Tax Deferred Mean. When someone sells assets in tax-deferred retirement plans the capital gains that would otherwise be taxable are. The Tax Deferred Exchange.

A 1031 exchange also called a like-kind exchange LKE Starker Trust or tax-deferred exchange was first authorized in 1921 when Congress recognized the importance of encouraging.

How 1031 Exchange Works Rexco 1031

1031 Tax Deferred Exchanges Building Wealth Through Real Estate Poulos Accounting

1031 Exchange In Florida A Simplified Explanation

1031 Exchanges Understanding The Rules And Benefits For Real Estate Investors

1031 Exchange Services Ohio Business And Tax Lawyers

What Qualifies For A 1031 Exchange Edmund Wheeler

What Is A Starker Exchange 1031 Exchange Experts Equity Advantage

All About 1031 Tax Deferred Exchanges Real Estate Investment Tips Youtube

Frequently Asked Questions Faqs About 1031 Exchanges

Are Tax Deferred Exchanges Of Real Estate Approved By The Irs Accruit

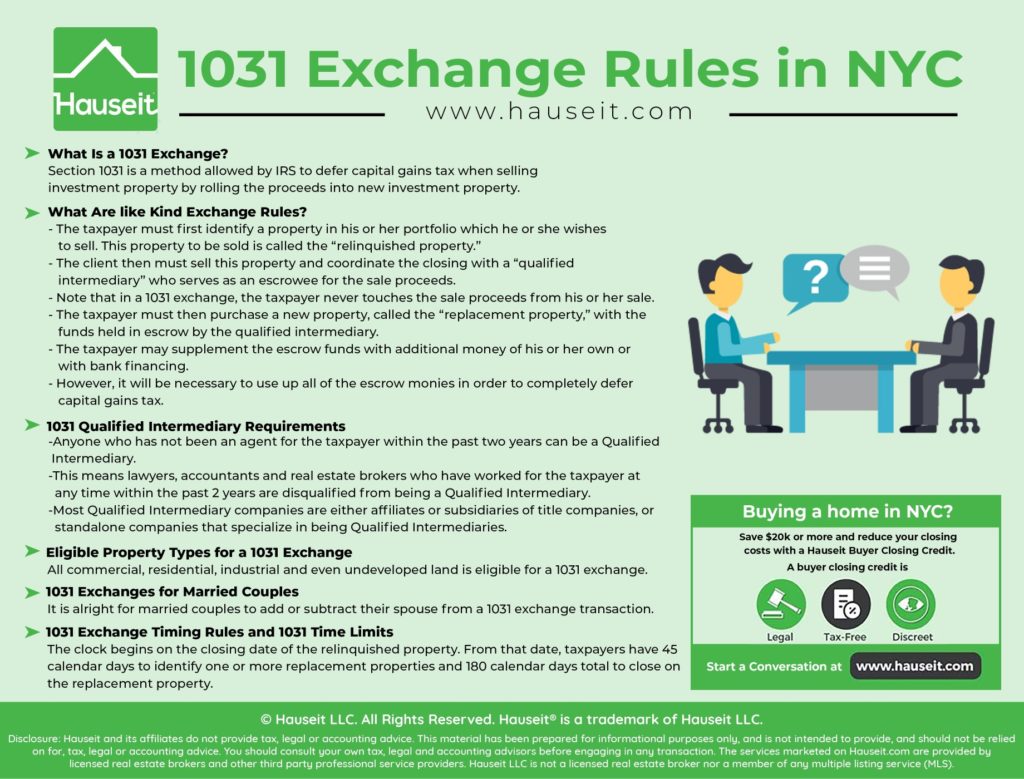

How To Do A 1031 Exchange In Nyc Hauseit New York City

Dictionary For Section 1031 Exchange Michael Lantrip Wrote The Book

1031 Tax Deferred Exchange Definition Sands Investment Group Sig

Irs 1031 Exchange Rules For 2022 Everything You Need To Know

1031 Exchange When Selling A Business

Top 1031 Exchange Real Estate Strategy Tips For 2022 Nnndigitalnomad Com

What Is A 1031 Exchange Dst How Does It Work And What Are The Rules