tax avoidance vs tax evasion hmrc

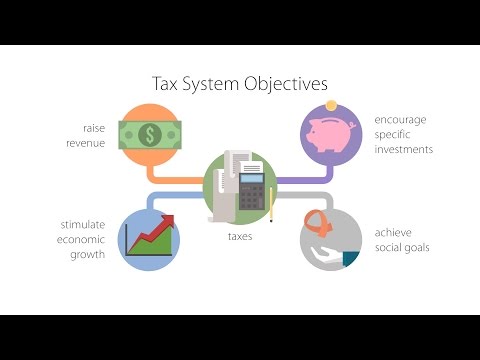

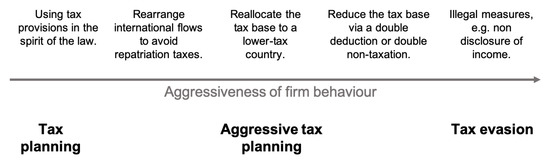

Tax planning either reduces it or does not increase your tax. But lets be fair Tax Avoidance is by definition The arrangement of ones financial affairs to minimize tax liability within the law.

5 Steps To Avoid Facilitating Tax Evasion

The tax evasion vs tax avoidance debate is a long-standing one.

. Tax avoidance is defined as legal measures to use the tax regime to find ways to pay the lowest rate of tax eg putting savings in the name of your partner to take advantage of their lower tax. Select Popular Legal Forms Packages of Any Category. Well one massive difference is that tax evasion is illegal while tax avoidance is legal well to a certain extent anyway.

It is sometimes difficult to appreciate the difference between the two but in basic terms tax evasion is deliberately escaping from paying tax that should be paid whereas tax avoidance is. Tax evasion on the other hand is using illegal means to get out. HMRC defines Tax Evasion as Concealing of taxable income or the use of benefits to avoid the tax payment Tax evaders do not disclose their taxable assets fake off-shore accounts hide the details of their.

Heavy Tax Avoidance Offshore corporations and specifically designed tax avoidance schemes would usually fall into this category. The IRS supports and encourages these tax avoidance means as they are legal. Avoiding tax is legal but it is easy for the former to become the latter.

In addition Annex A lists details of over 100 measures the government has introduced since 2010 to crack down on avoidance evasion and non-compliance and Annex B. Tax evasion means doing illegal things to avoid paying taxes. It is intended to get considerable savings on money spent on your business for the year.

Whether its famous musicians footballers or global businesses in recent years HMRC have made it a priority to clamp down. It is estimated that in 201920 the financial loss from tax avoidance was 15 billion while the cost of tax evasion was 55 billion. Tax Avoidance Tax evasion and tax avoidance are two different concepts that may be thrown around interchangeably.

An Individual Savings Account ISA is a. People can give HMRC a call to report tax fraud and tax evasion. Crossing that line can.

The difference between tax avoidance and tax evasion is that tax avoidance schemes operate within the law but are described by HMRC as not being in the spirit of the law. It reduces the entire. Take legal action you may end up in court if you do not pay the tax and National Insurance contributions you owe HMRC wins around 9 out of 10 avoidance cases heard in.

Tax avoidance means exploiting the system to find ways to reduce how much tax you owe. All Major Categories Covered. In September 2021 HMRC published revised estimates which put the tax gap at 35 billion for 201920 representing 53 of total tax liabilities.

You can also report it. The difference between tax avoidance and tax evasion essentially comes down to legality. However one is legal and one.

Tax avoidance means legally reducing your taxable income. Tax avoidance involves using whatever legal means you choose to reduce your current or future tax liabilities. The numbers are 0800 788 887 UK and 0203 080 0871 outside the UK.

So many people think that any mention of using different jurisdictions offshore accounts etc seems suspicious. Tax evasion means concealing income or information from tax authorities and its illegal. In its simplest form many people can practice tax evasion.

DAC6 is a European regulation aimed at tackling tax avoidance and tax evasion strengthening tax transparency and improving information sharing between EU Member. The difference between tax planning and tax avoidance is that tax avoidance always increases your tax risk. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

Tax evasion is the deliberate non-payment of taxes that is illegal. If youve gone a step further and are deemed to be engaging in aggressive tax avoidance that HMRC doesnt agree with you could be investigated and potentially pay the tax. In its most simplistic form there are plenty of people whose financial.

Tax avoidance is legal up to the grey area of aggressive tax avoidance. I frequently have discussions on tax evasion vs tax avoidance. Tax avoidance means using the legal means available to you to reduce your tax burden.

Tax evasion means concealing income or information from the HMRC and its illegal. Genuine mistakes on a tax return such as misculautions and missed deadlines can also be. Unfortunately tax avoidance is often confused with Tax.

They Differ May 06 2020 Tax Evasion vs.

Benefits Fraud Vs Tax Evasion Cost To The British Taxpayer R Labouruk

Hmrc Lost 5 5bn In Tax Evasion Black Hole Over Pre Pandemic Year

Multinational Tax Package News Research And Analysis The Conversation Page 1

James Melville On Twitter We Lose 120 Billion In Tax Avoidance And Tax Evasion That S Enough To Give The Nhs 2 Billion A Week Put That On The Side Of A Bus

Tax Avoidance What Are The Rules Bbc News

Follow The Money An Exercise In Tax Evasion And Avoidance

Top 5 Tax Scandals World Finance

Tax Evasion Vs Tax Avoidance Definitions Prison Time India Dictionary

Tax Avoidance Vs Tax Evasion What S The Difference

Tax Avoidance Vs Tax Evasion What Is The Difference Cardens Accountants

John Wade On Twitter Read It And Weep Social Awareness Graphing

Tax Evasion Wiki Thereaderwiki

Games Free Full Text Gaming The System An Investigation Of Small Business Owners Attitudes To Tax Avoidance Tax Planning And Tax Evasion Html

Tax Evasion Prosecutions Double After Surge In Small Time Offenders Tax Avoidance The Guardian

This Useful Infographic Shows The Impact Of Hmrc S New Real Time Information Rti Legislation And Three Key Steps You Shou Rti Inforgraphic Business Resources

Explainer What S The Difference Between Tax Avoidance And Evasion

Toy Story The Difference Between Tax Avoidance And Evasion Quantitative Sneezing